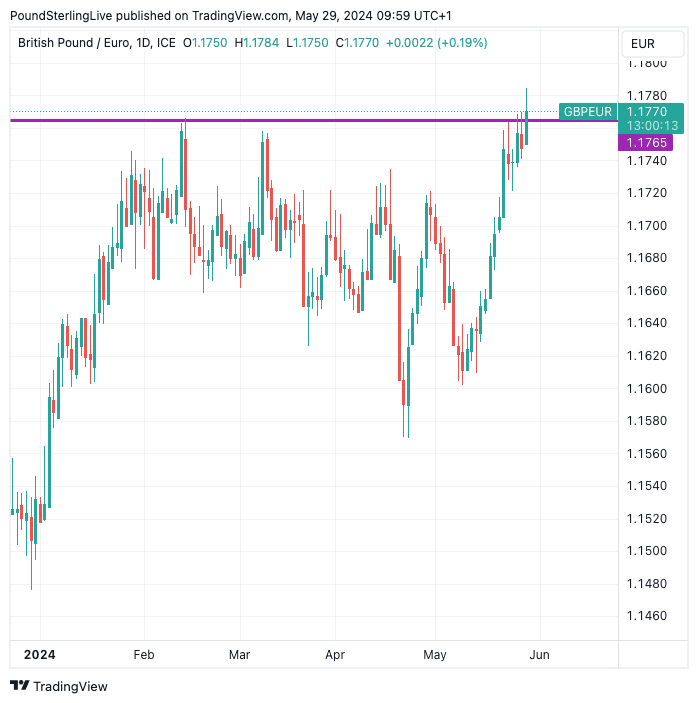

The pound-to-euro exchange rate rose to a new 21-month high at 1.1784 after German state-level inflation pointed to a slowdown in May, but analysts warn levels above 1.1765 will not be persevered.

Euro exchange rates were under pressure after state-level inflation in Germany slowed sharply, raising the prospect of soft inflation in the eurozone on Friday, opening the door to successive rate cuts at the European Central Bank in June and July .

In Germany’s most populous state, North Rhine-Westphalia, inflation fell to 0.2% month-on-month in May from 0.3% in April. In Saxony, inflation slowed from 0.6% to 0.1%; In Hessen, inflation levels off from 0.6% to 0%. Bavaria saw inflation fall from 0.6% to 0.1%.

Inflation for Germany as a whole was 0.1%, down from 0.5% and below the expected 0.2%. German data can sometimes overshadow the eurozone inflation figure released two days later, meaning this week’s inflation-related move in the euro is already underway.

By late morning, the euro was lower against all its G10 peers, meaning this is a euro-specific move that is driving GBP/EUR to new highs.

The European Central Bank will cut rates in June, but soft inflation in the euro zone on Friday could increase the chances of a second cut in July. This would put the ECB at the forefront of the rate-cutting cycle and punish the euro against central bank currencies that will be more reluctant to cut rates.

The midweek rally takes the British pound above the upper end of the 2024 range against the euro, and for some analysts the exchange rate is starting to look expensive.

Chris Turner, ING’s Global Head of Markets for Britain and Central and Eastern Europe, says he supports the resistance around €1.1765 as it looks like the pound will ignore domestic politics and instead will reflect interest rate expectations of the Bank of England.

“We think the market price of just 33 basis points for the Bank of England’s rate cuts this year is far too modest. And we think EUR/GBP will be largely supportive around 0.8500,” says Turner. EUR/GBP at 0.85 corresponds to a GBP/EUR conversion at 1.1765, which is the location of the upper resistance band:

Above: GBP/EUR at daily intervals, showing potential resistance. Track GBP/EUR with your own custom rate alerts. Set here

As you can see above, although GBP/EUR has risen in recent days, it has yet to convincingly defy the severity of the 2024 range.

The rally comes as investors assess the potential impact of a Labor government taking control on July 4. So far, markets seem relatively optimistic about such a prospect; Some analysts say a strong Labor majority could support the GBP.

“EUR/GBP continues to trade at lows. Labour’s shadow chancellor, Rachel Reeves, is making all the right budget noises – although the Labor Party may conclude that they have put themselves in a bind from a policy perspective if they win the July general election. The UK five-year credit default swap (CDS) falls and amounts to 25 basis points. The equivalent US CDS is rising and is at 43 basis points,” says Turner.

File photo of Labor leader Keir Starmer and Shadow Chancellor of the Exchequer Rachel Reeves. Image © Keir Starmer

“While the decline in UK CDS is welcome – and a long way from the 50bp-plus peak seen during Liz Truss’s short reign in 2022 – we think sterling will still largely offset the interest rate story,” he adds to it.

The chances of a Bank of England rate cut in June have diminished in the wake of last week’s above-consensus UK inflation data. They all but disappeared after Prime Minister Sunak announced the country would go to the polls on July 4 as all civil servants – including those at the Bank of England MPC – enter a period of purdah.

This enforced radio silence means the Bank cannot steer market expectations towards a rate cut in June, meaning such a move would be a big surprise to a market that isn’t expecting it.

Most economists we follow think a rate cut in August is likely. “We think the market price of just 33 bps for Bank of England rate cuts this year is far too modest,” says Turner.

33 bps suggests the market is prepared for just one cut. A second or even third price cut (assuming an August start) suggests there is room for market expectations to recalibrate and potentially weigh on the pound.